British insurance company Bikmo, which specializes in bike insurance, has released information on 2020 claims processed by the company. The information released was presented in as an “Open Project – Claims 2020” post on their website. The information included popular causes of claims and their locations, average replacement costs, along with the percentage of claims paid out by the policies offered by the company.

Accidental damage and theft made up for most of the claims.

Text continues below picture

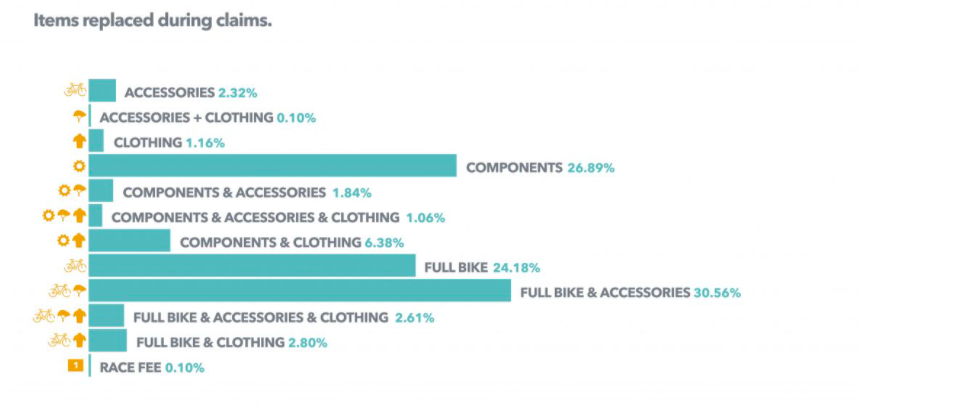

Items replaced by the insurer were also highlighted with components and full bike and accessories topping the list of things customers were able to get back after filing a claim.

Text continues below picture

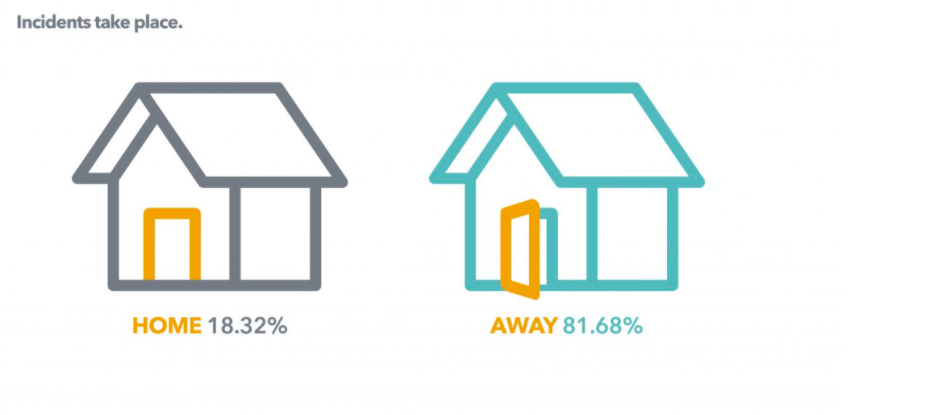

It was also interesting to note that over 80 percent of claims occurred outside of the home.

Text continues below picture

Payout on claims showed an average sum of 1,293 pounds (844 Euros/ US$1,804), with less than two percent of claims being on items valued north of 5,000 pounds (5,741 Euros /US$6,975).

Text continues below picture

“2020 has been a year like no other,” Bikmo CEO David George told endurance.biz. “Whilst presenting significant challenges and personal tragedy for millions across the country, it has also seen a positive shift in the way we travel.”

“Believing strongly in the values of openness and transparency, we have today released insights from our claims data in 2020, so that we can share some of the trends we’re seeing as well as better predict what lies ahead.”

This notion on predicting future trends within the industry offers some sad realities on theft claims, which the company expects to continue to rise as they doubled from 2017 to 2020 rates.

“Anyone who assumes their bike is covered by their home insurance should check the small print very carefully, as many will not cover incidents away from the home or accidental damage, and may have a single item/bicycle limit as low as £500,” the company warns. “As a result, we expect over 50 percent of UK cyclists to have no or little cover.”

While bike insurance against theft can be crucial for riders who use their bike as a main mode of transportation, a specific policy from bike related insurers can be the difference between staying on the road or being sidelined due to theft or damage.

One of the most notable pieces of information presented in the open project was on e-bikes, which are growing in popularity.

“Our recent study found that 38 percent fewer insurance claims arose from Bikmo riders on eBikes compared with traditional bikes.”